Insurance policies operate under the Principal of Indemnity: after a loss occurs, the insured should be restored to his/her approximate financial condition before the loss, no better, no worse and with no profit or betterment from the loss. (Subject to the conditions and limitations of the policy). The extent of loss is determined by the valuation or appraisal of the lost or damaged property.

VALUE: the significance, desirability, or utility of something. The monetary worth or price of something; the amount of goods, services, or money that something commands in an exchange. (Black’s Law Dictionary (Pocket), 3rd Edition)

VALUATION: the process of determining the value of a thing or entity. The estimated worth of a thing or entity. (Black’s Law Dictionary (Pocket), 3rd Edition)

APPRAISAL: the determination of what constitutes a fair price; valuation; estimation of worth. The report of such a determination. (Black’s Law Dictionary (Pocket), 3rd Edition)

APPRAISER: A person appointed by competent authority to make an appraisement, to ascertain and state the true value of goods or real estate. (Black’s Law Dictionary (Pocket), 3rd Edition)

“Insurance appraisal” provides an agreed method to settle claim damages disputes resulting in a valuation of loss damages as defined by the insurance policy. Information on the insurance appraisal process may be found elsewhere on this site.

Valuation Methods and Terminology

Replacement Cost Value (RCV)

“Replacement Cost Value” (RCV) refers to the current cost of a similar new property having the nearest equivalent utility as the property being appraised and is generally described as the current price of new for old “Like Kind and Quality” (LKQ) property. To establish LKQ, the features and qualitative differences of each original loss item are taken into consideration when researching for similar replacement items.

When evaluating RCV of new for old like kind and quality property one needs to consider the appropriate market and level of trade, given the set of circumstances. This due to the fact that new property has differentiated prices at the manufacturers’, wholesalers’ and retailers’ levels of trade as an item increases in value as it progresses through the distribution chain from manufacturer to wholesaler to retailer and subsequently is offered for sale at retail.

Both retail and wholesale markets, where new items, currently or recently manufactured, are available for first time sale are referred to as Primary Markets.

Within the retail market and level of trade, there are many vendor options one may consider. Examples include Department Stores – Mass Merchants, Specialty Retailers, Direct/Catalog, E-Commerce, Off Price Stores and Warehouse Clubs. There are many types of retail prices one may find presented in the marketplace: List Price, MSRP – manufacturer’s suggested retail price, MAP – minimum advertised price, Retail – the price any particular retailer elects to sell products at any given time.

Replacement Cost of any given new item is ultimately determined by the value that a willing buyer and seller would agree to if neither were under unusual pressure to buy or sell. Liquidation prices are typically not an appropriate measure of RCV as the term liquidation indicates unusual pressure to sell and therefore is not reflective of the general retail market. Sale pricing, however, is common in the retail marketplace, is widely anticipated by the consumer when purchasing personal property and does not constitute unusual pressure to sell.

Actual Cash Value (ACV) and Depreciation

“Actual Cash Value” (ACV) is commonly accepted to mean Repair or Replacement Cost Value (RCV) less a deduction for depreciation. Depreciation accounts for the decline of an item’s value since being placed into use. ACV accounts for the item’s current value after being used. Other concepts that dovetail with ACV and depreciation include remaining useful life which reflects the number of years in the future over which the continued use of an item is anticipated to be feasible. This remaining useful life can also be expressed as a percentage of the total useful life and may be referred to as: RESIDUAL or REMAINING PERCENT GOOD. Thus, both RCV less depreciation = ACV and RCV times RESIDUAL PERCENT GOOD = ACV. ACV may also be thought of in terms of a REMAINING UTILITY or RESIDUAL VALUE.

It is common practice to consider an average percentage yearly rate to aid in the determination of an appropriate amount of depreciation to establish the value of used property in various categories.

Depreciation Rates

A common method employed by valuation professionals to estimate reasonable rates of depreciation is to consult the United States Joint Military Industry Depreciation Guide – Aka Allowance List Depreciation Guide. This guide specifies rates of depreciation and is periodically published by the Department of Defense for use in adjudicating military personnel claims for losses incurred during transportation of personal items/household goods while under orders or losses at assigned quarters or other authorized places. The Code of Federal Regulations: Title 32 – National Defense, Part 751 Personnel Claims Regulations, 751.12 Computation of Award stipulates that the Judge Advocate General will periodically publish this Allowance List – Depreciation Guide specifying rates of depreciation applicable to various categories of property.

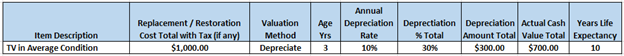

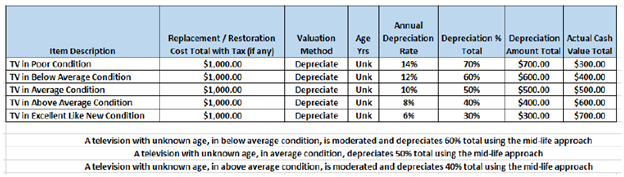

The depreciation table rates are calculated on a straight line basis to reflect the average total serviceable useful life of various product categories. In this illustration, televisions have a useful life expectancy of 10 years and an annual depreciation rate of 10%. (100% useful life / 10 years) = 10% rate.

Broad Evidence Approach

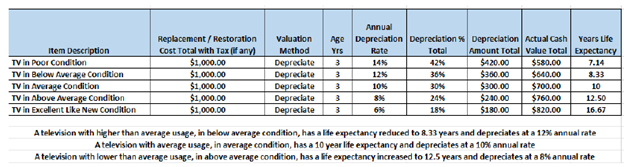

Factors in addition to age and useful life span come into play in the determination of actual value as one applies a broad spectrum of reasoning, considering any evidence that can establish correct proper value, for the calculation of Depreciation and Actual Cash Value. Additional factors one may consider beyond the property category and age include the general condition and/or the past usage of the item.

Since more limited usage of an item would typically yield greater lifespan, such an item would depreciate at a lesser rate than one put to average use. Conversely, an item that has experienced greater than average usage would deteriorate more quickly and would depreciate at a higher rate than one put to average use. In addition, an item in better than average condition than that expected, given its age, would be anticipated to have greater remaining life and would depreciate less than the norm. Conversely, an item in lesser condition than that expected, given its age, would be anticipated to have a lesser remaining life and would depreciate more than the norm.

The example below illustrates how broad spectrum reasoning allows for variance in the amount of depreciation to account for the measurable difference in value between new and old property that is attributable to condition and age.

Another concept worthy of note in the consideration of depreciation and actual cash value is that of EFFECTIVE AGE, this being an age assigned to an item based on a combination of its actual age and condition. Depreciation based on effective age might involve adjustments for unusual physical deterioration: unusual exposure to the elements; poor maintenance; and excessive or unusual use.

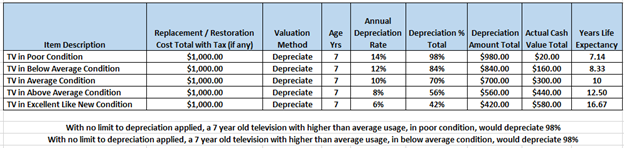

When considering Items of advanced age, another broad evidence element may come into play. Viewing the illustration below, one can see that a TV in poor condition, aged 7 years depreciates 98% (7 x 14% = 98%). In order to recognize that an item of advanced age, if still in operable condition, may have remaining utility and consequently a residual actual cash value, it is common practice, in such cases, to moderate or limit depreciation.

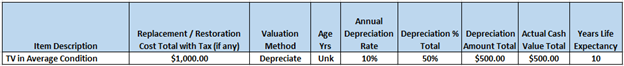

There are instances where the age of a particular used item cannot be determined with any degree of accuracy. In these cases, if one were to attempt the calculation of depreciation using the formula (age x rate of depreciation) the result would be zero – as zero (0) age times any percentage depreciation rate would yield a 0% total depreciation. This would defy logic whereby an item known to be used would be expected to be worth less than a new item of the same type. A frequently utilized broad evidence method to address this issue might be referred to as a mid-life approach. Here, given no evidence to the contrary, one might make the extraordinary assumption that an item with unknown age is of average age and that it is at the mid-point in its useful life span. For any class of property, for an item subjected to average use, whatever the associated expected life span in years, middle of age would indicate a 50% depreciation rate – half of its life used – half of its life remaining.

Additionally, in the valuation of ACV, applying the broad evidence approach, one would weigh any additional factors such as the reduction in value when items are considered as obsolete due to innovation, changes in technology or change in demand.

Fair Market Value (FMV)

“Fair Market Value” (FMV) is commonly defined as the price that both a willing buyer and seller would agree to if neither were under unusual pressure to buy or sell with both having reasonable knowledge of relevant facts.

In the case of objects of art, collectibles, vintage, and antique items there are no new Like Kind and Quality equivalents, they may not suffer depreciation and may actually appreciate in value over time. Fair Market Value reflects the current value given current market conditions. In valuation scenarios, there is no depreciation taken on an item valued at FMV. In those cases, one might say FMV = ACV = RCV.

Markets where used items are resold to subsequent buyers are considered secondary markets. Secondary retail markets include antique/vintage shops, consignment stores, thrift/charity shops, flea markets, antique fairs, swap meets, garage sales, estate sales, printed and on-line classified ads and online auction sites. In the case of items that are no longer being manufactured, antiques, collectibles and vintage items, the secondary retail market becomes the primary market. These types of outlets are appropriate when researching FMV.

Auctions and orderly liquidations, where property is advertised for sale with reasonable exposure time and allowing for a reasonable amount of time to complete a transaction are other venues to consider when researching FMV. Examples would include auction galleries, on-site auctions and estate tag sales. Auction replacement value includes any applicable sales tax, commissions and/or premiums. Marketable cash value is simply orderly liquidation (auction replacement value) value minus costs associated with the sale.

The forced liquidation market, where property is sold within a short time frame without regard to other markets where the sale value of the property might be optimized are not of the “willing buyer/willing seller” type and consequently are not typically considered viable sources of FMV data. Forced liquidation value examples would include the “give away” prices at the very end of an estate or yard sale or as in the auction of storage unit contents.

When conducting comparable sales research for prices at which similar items have recently sold, one may consider both past consummated sales and the asking prices of items currently for sale. This, with the caveat that some asking prices may be out of line with the market when a seller has inflated a price in the hope of a windfall profit or in the case where a seller is under duress to sell and prices an item significantly below the norm to stimulate a quick sale.

Many will recognize EBay.com as an on-line auction site of used goods and may associate those sales with a consumer to consumer or peer to peer market. It may be interesting to note that the company is positioned today as the EBay Marketplace and that greater than 80% of the site’s transactions are now merchant to consumer and involve new merchandise. Consequently, one needs to differentiate EBay research between new or used, as well as whether the illustrated cost reflects buy it now pricing, pending sale and/or closed auction results.